Best Debt Consultant in Singapore: Your Overview to Financial Liberty

Wiki Article

Open the Perks of Engaging Debt Expert Solutions to Navigate Your Course Towards Financial Obligation Alleviation and Financial Flexibility

Involving the services of a financial debt specialist can be an essential action in your trip towards achieving financial debt alleviation and monetary security. These experts offer customized methods that not only examine your special monetary conditions however also offer the vital support needed to navigate complex settlements with creditors. Understanding the diverse benefits of such competence may disclose choices you had not formerly taken into consideration. Yet, the inquiry stays: what certain benefits can a financial obligation expert bring to your economic circumstance, and exactly how can you identify the right companion in this endeavor?Understanding Financial Obligation Expert Solutions

Financial obligation professional services use specialized guidance for individuals grappling with economic difficulties. By examining your revenue, debts, and expenditures, a financial obligation consultant can help you identify the origin triggers of your financial distress, permitting for an extra accurate technique to resolution.Debt experts generally employ a multi-faceted approach, which may include budgeting aid, settlement with financial institutions, and the development of a strategic payment plan. They act as middlemans between you and your lenders, leveraging their knowledge to work out much more desirable terms, such as reduced rate of interest or prolonged repayment timelines.

In addition, financial debt professionals are furnished with up-to-date expertise of appropriate regulations and guidelines, ensuring that you are educated of your civil liberties and alternatives. This professional assistance not only reduces the psychological concern associated with debt but additionally empowers you with the tools needed to regain control of your economic future. Ultimately, engaging with debt professional services can result in a more enlightened and structured course towards financial stability.

Secret Benefits of Specialist Assistance

Engaging with financial obligation consultant services provides various benefits that can dramatically improve your monetary circumstance. One of the key benefits is the expertise that consultants offer the table. Their considerable expertise of debt management strategies permits them to tailor services that fit your unique scenarios, making sure a much more effective approach to attaining economic stability.In addition, financial debt consultants often give settlement support with creditors. Their experience can bring about a lot more desirable terms, such as minimized rate of interest rates or worked out debts, which may not be attainable with straight settlement. This can result in considerable financial relief.

Furthermore, consultants offer a structured plan for repayment, assisting you focus on financial debts and allocate sources successfully. This not only simplifies the settlement procedure however additionally fosters a feeling of liability and progress.

Inevitably, the combination of specialist assistance, arrangement abilities, structured repayment strategies, and psychological assistance positions debt professionals as beneficial allies in the quest of debt relief and monetary flexibility.

How to Select the Right Expert

When selecting the best debt professional, what vital elements should you take into consideration to ensure a favorable result? First, examine the specialist's credentials and experience. debt consultant services singapore. Try to find certifications from identified organizations, as these show a degree of expertise and expertise in the red administrationNext, take into consideration the expert's credibility. Study on the internet reviews, testimonies, and scores index to gauge previous clients' complete satisfaction. A strong track document of successful financial obligation resolution is vital.

Additionally, examine the expert's strategy to financial obligation management. A good professional should use individualized services customized to your unique financial situation instead of a one-size-fits-all remedy - debt consultant services singapore. Transparency in their processes and fees is critical; guarantee you comprehend the prices entailed before devoting

Interaction is another essential element. Pick an expert that is eager and friendly to answer your concerns, as a solid working connection can boost your experience.

Usual Financial Obligation Alleviation Techniques

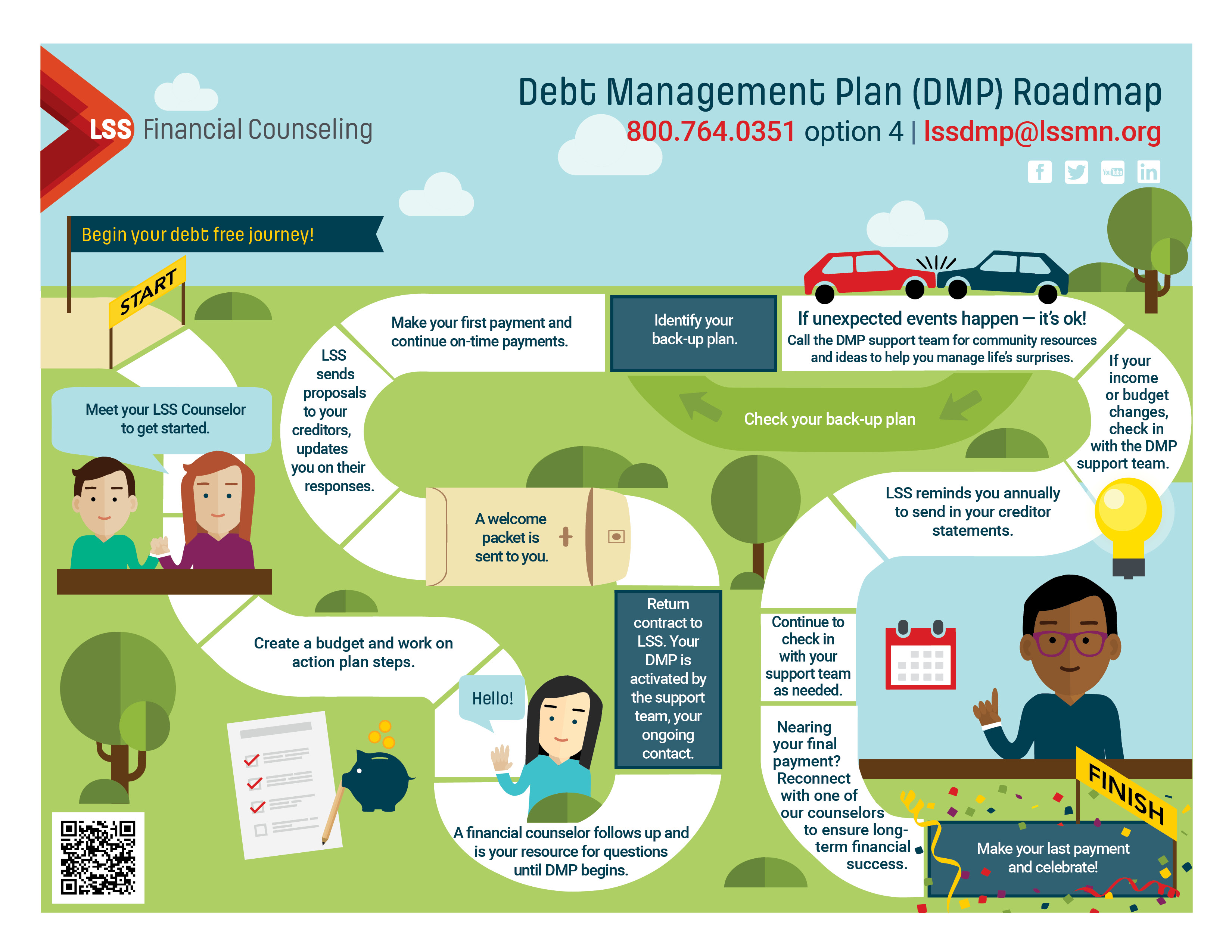

While various financial obligation relief strategies exist, picking the best one depends upon specific monetary conditions and objectives. A few of one of the most common techniques consist of debt consolidation, financial debt administration plans, and debt negotiation.Debt loan consolidation involves integrating several financial debts right into a solitary car loan with a reduced rates of interest. This strategy streamlines repayments and can minimize regular monthly responsibilities, making it less complicated for individuals to gain back control of their financial resources.

Debt administration plans (DMPs) are created by credit rating counseling firms. They bargain with creditors to lower interest prices and produce an organized settlement strategy. This alternative enables people to pay off financial debts over a set duration while benefiting from expert guidance.

Debt settlement entails negotiating directly with creditors to settle financial obligations for much less than the overall quantity owed. While this strategy can provide immediate alleviation, it might affect credit rating and typically includes a lump-sum payment.

Finally, bankruptcy is a legal choice that can offer relief from frustrating financial debts. Nevertheless, it has long-term financial effects and ought to be taken into consideration as a last hope.

Selecting the proper approach calls for cautious analysis of one's economic circumstance, making sure a tailored method to achieving long-lasting security.

Steps In The Direction Of Financial Liberty

Following, establish a reasonable spending plan that focuses on basics and fosters savings. This spending plan should include provisions for financial debt repayment, permitting you to designate excess funds successfully. Following a spending plan assists cultivate self-displined costs behaviors.

Once a budget is in area, take into consideration involving a debt specialist. These specialists use customized approaches for managing and reducing debt, offering insights that can quicken your trip towards economic flexibility. They might advise options such as debt loan consolidation or negotiation with financial institutions.

Furthermore, emphasis on developing an emergency fund, which can prevent future economic pressure and give peace of mind. With each other, these steps develop a structured approach to accomplishing financial freedom, changing goals right into truth.

Final Thought

Engaging debt professional services supplies a calculated technique to achieving financial debt relief and monetary liberty. These specialists provide necessary advice, customized strategies, and emotional support while guaranteeing compliance with pertinent legislations and regulations. By focusing on financial debts, bargaining with financial institutions, and carrying out organized payment strategies, people can restore control over their economic circumstances. Eventually, the knowledge of financial obligation professionals dramatically improves the likelihood of browsing the complexities of financial debt administration successfully, resulting in a much more protected financial future.Engaging the solutions of a financial obligation consultant can be an essential action in your trip in the direction of accomplishing financial obligation relief and economic security. Financial obligation expert solutions use specialized assistance for people grappling with financial challenges. By assessing your income, financial obligations, and costs, a financial obligation see here consultant can aid you identify the origin causes of your monetary distress, enabling for a more exact technique to resolution.

Involving debt professional solutions offers a critical method to attaining debt relief and financial flexibility. Inevitably, the experience of debt professionals substantially enhances the likelihood of browsing the intricacies of debt monitoring efficiently, leading to a much more safe and secure financial future.

Report this wiki page